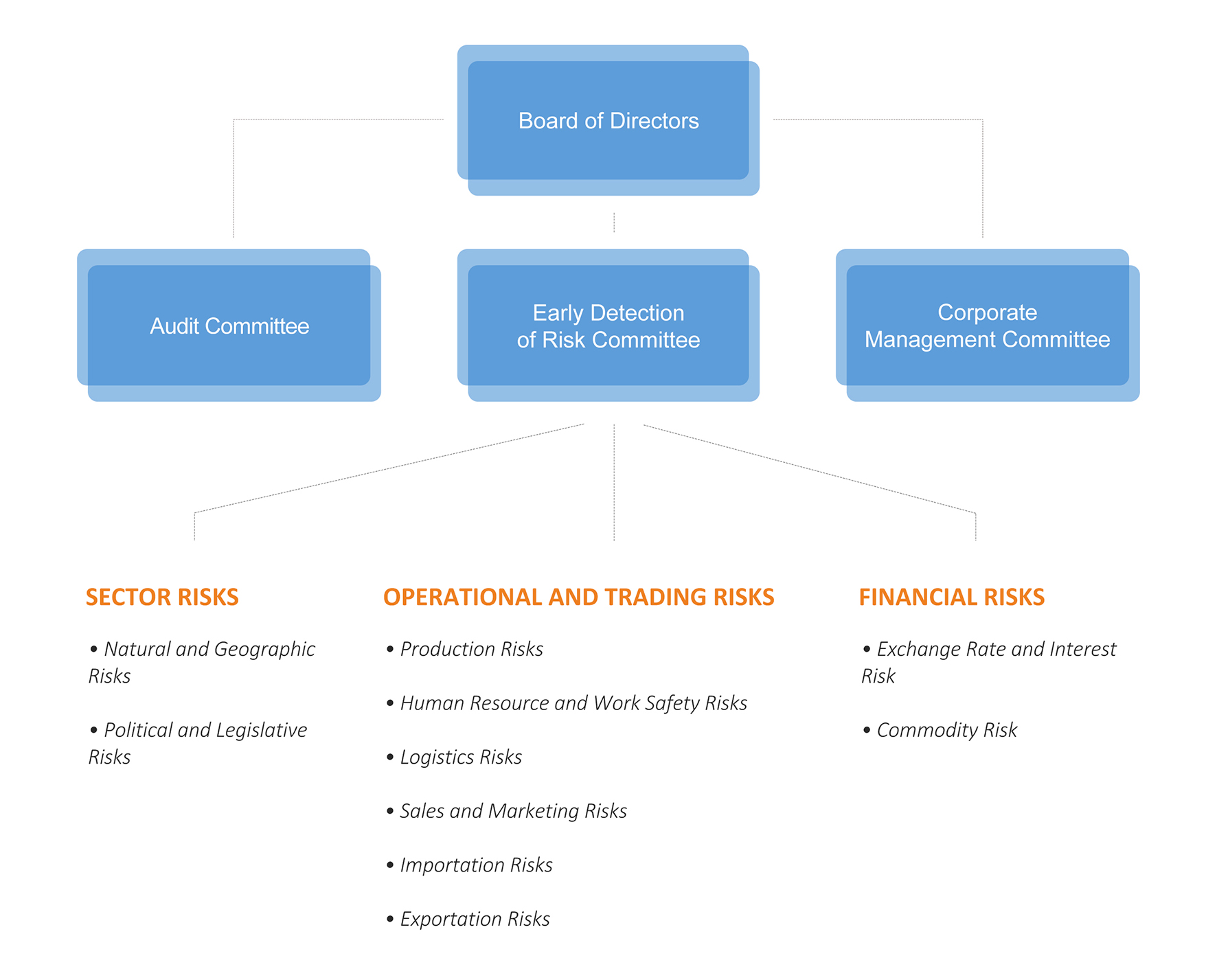

SECTOR RISKS

Natural and Geographical Risks

Hail, frost, fire, drought, storm and flood are the leading natural risks related to agricultural production.

Although Turkey has a great potential in plant production and animal production, it has not achieved desired levels of agricultural production. Accordingly, fluctuations in demand – supply balance might have impact on the prices and thus disturb profit margins of the Company.

Production mainly depends on natural conditions and this dependency might cause product yield and producer income, profitability fluctuations.

Our country is exposed to product loss risk due to bacterial, fungal and viral plant diseases and harms.

Natural and geographical risks are defined as risks that cannot be fully foreseen and measured. However, the Company closely monitors the expected product harvests on regional and international level by bearing in mind the possibility of foregoing risks and increases the critical stock levels in order to prepare for potential raw material price increases to be caused by decreased product yields.

Besides, the company manages the risk through derivatives on commodity exchanges.

Politicial and Legislative Risks

Any changes on the government’s agricultural policies and any changes that might narrow the profit margin might have negative impact on the Company’s profitability since the main input of the Company, namely wheat, is directly controlled by the government’s agricultural policies.

The global economic problems and potential product price fluctuations caused by such problems might have negative impact on the agriculture sector. Production mainly depends on natural conditions and this dependency might cause product yield and producer income, profitability fluctuations.

Since the profit margins in the sector are low and a price oriented competition approach dominates the market, any potential increases on general expenses and production costs might have negative impact on the sector and reduce the profitability level.

The company manages the political and legislative risks related to the sector with methods similar to the ones used for natural and geographical risks.

OPERATIONAL AND TRADING RISKS

Production Risks

This category covers process risks that might prevent producing products according to the expected quality level, contents and standards.

Foreign substances might be mixed with the product in production line on each stage and between stages while transforming wheat into flour by processing wheat as a raw material.

Another risk would be flocculation, molding and infestation on nooks and obsolete sections of production facilities, production team and equipment, packing – shipment and warehouses.

If the main production machines are broken, broken down etc., such problems might cause the risk of suspending production.

Magnets and waste purifiers are used at raw material input processes in order to keep foreign substances away from related processes. Products are sampled and tested at specific stages in order to check quality.

Employees are continuously and regularly trained on such matters; cleaning and control processes are supervised using “random sampling and period” methods. Besides, the critical points are determined (Final Check Sieve and Metal Detector) and risks related to these points are eliminated.

Machines are regularly maintained and repaired; the company does not wait for machine malfunctions to do maintenance and repair works and to replace spare parts; qualified teams quickly eliminate any malfunctions and problems.

There are comprehensive insurance policies against all kinds of machine breakdowns.

Human Resource and Work Safety Risks

There might be occupational health & safety risks related to any potential work accident and other risks related to failing to employ manpower that is fit for the job and that will not interrupt business continuity.

Personnel trainings on potential work accidents are offered regularly. Besides, an Occupational Safety Specialist is hired pursuant to the legislation in force.

The Company has a Human Resources Department that is in charge of risks related to inefficient use of manpower available and confusion about employee roles and responsibilities; the department continues to take effective measures, plan employee backups for key roles and positions as well as duly reporting to and informing the management.

Logistic Risks

This category covers operational risks in purchasing (supply), storage and shipment processes.

There is a risk of being exposed to operational risks related to the processes of transporting purchased raw materials to the Company warehouses, keeping them in stock and transporting from warehouses to the production or sales locations.

Loss, spillage, accident and such other risks related to all transportation / shipment processes of the Company are covered under comprehensive insurance policies. Besides, there are insurance policies against losses and damages suffered at the warehouse due to flood, fire, burglary etc. Efficient internal control mechanisms are in place particularly for shipment and storage processes.

Sales and Marketing Risks

The risks are current account balances due to credit sales made to margin trading customers as well as bounced, uncollected checks-bills and such other bonds.

Another risk would be misconduct attempts of the personnel assigned as collectors on local fields.

The rivals might prefer to practice aggressive competition in the domestic market and new players might be introduced to the market.

The Company performs necessary market searches before offering credit (forward) sales, as required under the Company’s risk policy, and a risk score as well as a limit are specified for customers offered with such sales. These specified risk and limit restrictions are applied to subsequent operations.

Inspectors, assigned to the locations where the Company is present in the domestic market, do inspections at random periods and with random samplings and comprehensive insurance policies are issued against the misconduct attempts.

The risks related to introduction of new players into the market and existing players practicing more aggressive sales policies are always in agenda and the Company’s Sales and Marketing Department keeps up with the developments in the domestic market in order to be prepared for such risks.

Importation Risks

This category covers all kinds of risk related to importation markets.

Any crisis, amendment related to production and tax policies in the country of importation is considered as a risk.

The company determines and keeps critical inventory levels in order to prepare for such negative incidents.

The company keeps a close eye on the global crop expectations and monitors alternative importation markets as well as keeping alternatives as backup.

There are comprehensive insurance policies covering logistic risks in importation processes.

Exportation Risks

This category covers all kinds of risks related to exportation markets.

Anti-damping practices in countries of exportation as well as political, economic and conjectural instabilities and negativities in these countries are the related risks.

Both in-house specialists and professional institutions of our sector take measures against the anti-damping practices.

The Company’s Exportation Department always monitors the exportation markets and does active searches as well as keeping alternative markets as backup in order to be prepared for the risk of conjectural, political and economic depressions in these markets.

FINANCIAL RISKS

Exchange Rate and Interest Risk

This category covers risk of exchange rate changes on assets and debts in foreign currency as well as cost and cash flow risks related to increased interest rate applied to the financial debts.

The exchange rate risk is a result of foreign exchange gap between the Company’s liabilities and assets in foreign currency. There will be a foreign exchange gap if the liabilities in foreign currency are more than the assets.

Foreign exchange gap of our company is being effectively managed against fluctuation risk through Futures Exchange transactions and forward transactions at banks and we are able to transform them into foreseeable financial outcomes.

The position acquired changes based on market developments and hedging model applied.

Since there is a risk of sudden increase in variable interest rate of short and long term liabilities, the company’s Finance Department closely monitors the market and keeps an open mind for alternative methods.

Raw Material Price Change Risk

This category covers the risk of wheat price changes in the internationally organized markets which might be disadvantageous to the Company.

The exchange rate risk is a result of foreign exchange gap between the Company’s liabilities and assets in foreign currency. There will be a foreign exchange gap if the liabilities in foreign currency are more than the assets.

TMO (Soil Products Office) regulates the wheat prices in our country. There are different methods used to control the market in order to protect the producers when the prices go down and to protect the consumer when the prices go up.

According to the actual wheat position available in our inventory; the risks are limited through partial hedging transactions on Cbot (Chicago Board of Trade) and Matif exchanges at levels where the domestic wheat price and overseas exchange price spreads are widened.