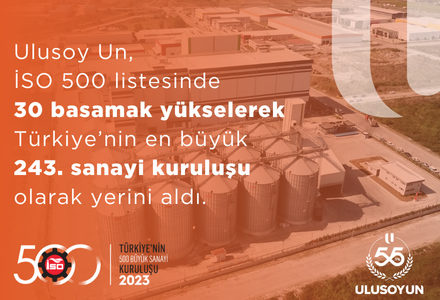

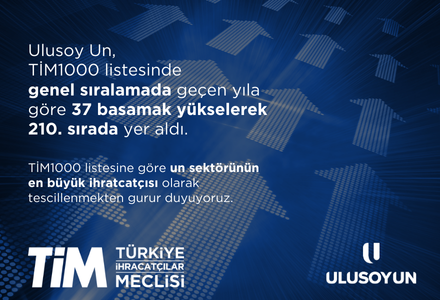

- Announcements

- Sustainibility

-

- Board Members

- Committees

- Audit Committee

- Early Detection of Risk Committee Regulation

- Corporate Governance Committee

- General Assembly

- Our Company's Policies

- Risk Management

- Corporate Governance Compliance Report

- Sustainability Report

- Ethical Values

- List of Those Who Have Access to Insider Information

- The Main Word. Av.Structure and Trade. Record

- Privileges

- Independent Auditor Information

- Contact

- EN